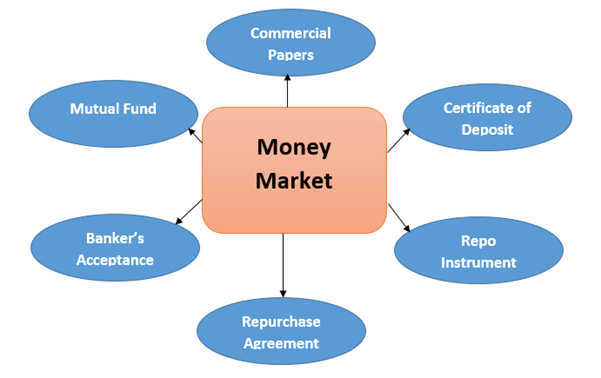

The future of money market accounts is important for both individuals and businesses that handle money. The ways people save and spend their money change along with the way personal finance changes. At the center of these changes are money market accounts, which have long been known for being stable and easy to get cash from. the future of Money Market accounts in light of new technologies, changing customer tastes, and changes in the way regulations work. We look into the things that will affect the future of these financial instruments, from their past contexts to the problems they face today. Understanding these changes is important for people who want to get the most out of their savings plans and for banks that need to adapt to meet changing market needs.

Evolution of Money Market Accounts

Money market accounts have changed over time from simple cars that earn interest to more complex financial tools. They were first created as safe ways to store cash, but over time they’ve changed into flexible tools with high returns and easy access. Their features and functions have changed over time as technology has improved and legal frameworks have changed. From simple interest credits to complex digital platforms, the change shows how the financial markets are always changing and how investor needs are also always changing. Today, money market accounts are still changing. They now include new features like mobile banking and digital solutions, which makes them useful for modern portfolio management.

Current Trends in Money Market Accounts

Money market account trends right now show how new technologies and changing customer needs are coming together in the financial world. Along with competitive interest rates, easier access, and the addition of new features, these changes show that money market accounts are flexible enough to meet investors’ changing needs.

Competitive Interest Rates

One common trend in money market accounts is the focus on competitive interest rates, which draw buyers who want to get the best return on their money. Competing banks set to make the world of savings and investments more active and competitive by offering higher Annual Percentage Yields (APYs).

Better accessibility and ease of use

With online and mobile banking features built in, modern money market accounts are easier to get to and more convenient. Investors now have smooth transactions, actual time account management, and the freedom to keep an eye on and handle their money. This shows that the industry is committed to meeting the changing needs of clients who are always online.

Innovative Features and Services

Money market accounts are getting new features and services all the time, which is another trend that stands out. Benefits like automated savings tools, personalized financial help, and simple interfaces are being added by financial institutions. This trend fits with the overall goal of the industry to give account users a complete and technologically advanced financial experience.

Evolving Regulatory Environment

The current state of money market accounts is greatly affected by how regulations are changing. Financial institutions have to deal with compliance problems as regulatory systems change to keep up with the changing market. It is likely that institutions will make changes to account structures and offers as they try to meet new regulatory standards. This will keep money market accounts stable and reliable.

Challenges Facing Traditional Money Market Account

As the financial world changes, traditional money market accounts face a number of problems. Some of these problems are low interest rates, more competition from other business options, rules and regulations that make it hard to change, and keeping up with new technologies. Getting rid of these problems is important for keeping traditional money market accounts useful and appealing in today’s hectic financial world.

Low rates of interest

The current low interest rate situation is a big problem for traditional money market accounts because it makes them less attractive as ways to make serious returns. Investors looking for higher returns may look into other investment choices. This could make it harder for traditional money market accounts to attract and keep customers money.

Low rates of interest

Alternative investment tools that could offer higher returns are making it harder for traditional money market accounts to stay in business. Because there is so much competition, banks have to look at their account features, interest rates, and customer benefits all over again to keep investors’ money.

Regulatory Constraints

It can be hard for standard money market accounts to stay within the rules because compliance requirements are changing and getting stricter. Financial companies have to spend money to make sure they follow regulatory rules, which could affect the types of accounts they offer and how efficiently they run their businesses.

Technological Advancement

Traditional money market accounts have to change to keep up with the fast pace of technological progress and meet the changing needs and wants of customers. If you don’t use new technologies like digital financial platforms and mobile banking features, your business may lose its appeal and ability to compete in the market.

New technologies are changing the way money market accounts work in the future

New technologies are changing the way money market accounts work, leading to new ideas and changes in personal spending. These improvements, like integrating blockchain and giving financial advice based on AI, create new possibilities for both account holders and financial institutions. They signal a future where money market accounts are more flexible, easy to use, and suited to each person’s needs.

Blockchain Integration

The addition of blockchain technology has the huge potential to change money market accounts by making deals safer, more open, and more efficient. Blockchain-based money market accounts allow for faster settlements, lower transaction costs, and more trust among account users. This makes them new and safe options in the financial market.

AI-Powered Financial Advice

AI-powered financial assistance, which suits your advice and suggestions to individuals financial goals and preferences, is changing money market accounts. These platforms use machine learning algorithms to look at huge amounts of data and come up with the best ways to save money, invest, and handle risk. This gives account holders the information they need to make smart financial choices.

Mobile Banking Features

More and more mobile banking features are changing money market accounts, making them easier to use and more accessible than ever before. Mobile apps make it easy to handle accounts, make transactions in real time, and get personalized alerts. This improves the overall user experience and gets more people involved with money market accounts in a world that is becoming more and more digital.

Integration with DeFi Platforms

By connecting money market accounts to decentralized finance (DeFi) platforms, people can get new ways to get cash and use cutting-edge financial goods and services. DeFi-enabled money market accounts let account holders lend and receive money without going through a central bank. They also offer yield farming and liquidity provision, giving account holders more options and the chance to make money.

Changes in the rules that affect money market accounts

Changes in regulations have a big impact on money market accounts, changing how they are set up, what services they offer, and how they are run. Government policies and financial rules that change have big effects on both financial institutions and account holders. These changes can affect things like interest rates, how easy it is to get to your account, and how you handle risk.

Government Policies and Regulations

Money market accounts are greatly affected by government rules and policies, which determine account designs, interest rates, and the kinds of investments that are allowed. Regulatory changes, like changes to monetary policies and reserve requirements, have a direct effect on how profitable and liquid money market accounts are. These changes affect both financial institutions and account users.

Compliance Challenges for Financial Institutions

Changing regulatory frameworks make it hard for financial institutions that offer money market accounts to stay in compliance. They have to constantly watch and change their practices to meet new regulatory requirements. To ensure the honesty and stability of money market account operations, financial institutions perform risk assessment, meet reporting requirements, and comply with anti-money laundering (AML) and know-your-customer (KYC) rules.

Impact on Account Offerings

Changes in regulations greatly affect the features and options of money market accounts. Banks must adapt to meet the new rules set by regulators, which can impact how accounts are set up, interest rates, withdrawal limits, and investment choices. This means that banks have to change the products they sell to stay in line with the rules and compete in the market.

Investor Protection Measures

New rules are meant to make investor protections better in money market accounts. This will protect account users’ interests and keep the market stable. Regulations like deposit insurance schemes and disclosure requirements make sure that everyone is clear and accountable. This gives investors faith that money market accounts are safe and reliable to hold their money in.

Conclusion

In conclusion, Money market accounts will only be around for a while longer if they can adapt to new technologies, changing rules, and shifting buyer tastes. Understanding these changes is important for making the best planning plans and making sure that financial institutions can meet the needs of the market. The future of money market accounts will depend on how open people are to new ideas and how well they follow the rules.