It can be hard to figure out how to invest your money, but when it comes to money market accounts, it’s very important to find the right mix between safety and returns. Investors want both safety and growth for the money they have invested in today’s unstable financial world. Money market accounts are one of the best ways to find this careful balance. We’re going on an exploration to give investors the information they need, from figuring out the complexities of security to using the power of returns. Learn the rules, strategies, and things to think about that are necessary to handle money market accounts with trust and care.

Understanding Money Market Accounts

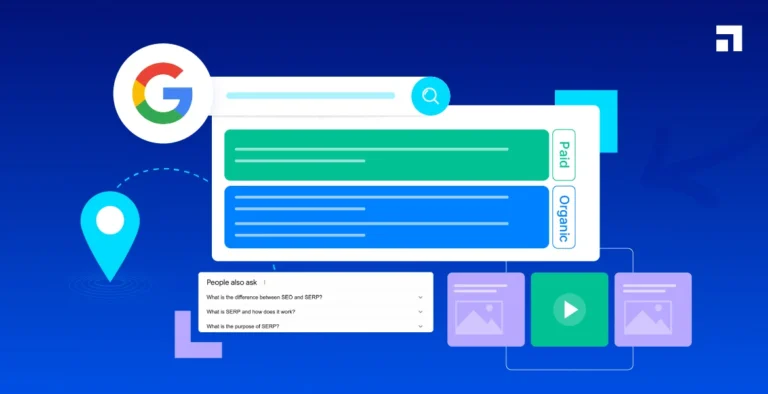

Money market accounts are a type of savings account that gives investors a balance of security and liquidity. Most of the time, temporary, safe investments like Treasury bills, CDs, and commercial paper are put into these funds. In addition to earning more interest than regular savings accounts, they are a safe place to keep money. A lot of the time, money market accounts let you write checks and use ATMs, which makes them useful for everyday tasks. They are a good choice for people who want a mix between safety and modest returns because investors like how stable they are and how easy it is to get their money out of them.

The Importance of Stability

Stability is very important in a world where money is always changing hands. It gives buyers confidence and peace of mind by protecting them from market volatility and sudden drops. People can confidently go after their financial objectives in the future when they are financially stable. Without stability, investments can go up and down, which can lead to the loss of wealth and financial protection.

Stability Amid Uncertainty

When there is a lot of market or economic upheaval, stability is a good thing to have. It gives buyers a sense of security and makes them resistant to sudden changes, giving them a way to weather uncertain times. People can protect their assets and stay financially stable even when things go wrong by making business decisions that prioritize stability.

Preserving Capital

Stability is a key part of keeping capital because it keeps investments’ value stable over time. Stability helps investors protect their wealth and reach their future financial goals by lowering the chance of losses and keeping the principal amount. This protection of capital is what makes it possible to build and steadily increase wealth over time.

Mitigating Risk

Stability protects investments from risks by lowering the chance of big losses or changes in price. By focusing on stability in their financial portfolios, people can lower their risk and protect themselves from sudden changes in the market. This proactive approach to risk management makes the general financial situation stronger and protects against possible bad outcomes, making the investment journey more stable and safe.

Building Trust and Confidence

When financial markets are stable, buyers trust and believe in them, which makes them feel like they can rely on them. When buyers are sure that their investments are safe, they are more likely to stick to their plans for the future. This trust is the foundation of a strong and successful financial system that leads to long-term growth and wealth.

Maximizing Returns

When it comes to investments, investors who want growth and wealth want to get the best returns possible. This means using strategies and techniques to get the most out of investments and get better returns. Investors can increase their returns and reach their financial goals more quickly and easily by using the power of compounding, variety, and smart risk management.

Harnessing Compounding Effect

Compounding lets buyers get back not only the money they put in at first, but also the interest or dividends that have grown on top of it over time. Using the power of compounding to get big returns over the long term, investors can make their money grow by investing earnings again and again. This technique is essential for getting rich and making your investments grow faster.

Diversification for Enhanced Returns

Diversification means spreading your money around investments in various types of assets, businesses, and areas of the world in order to lower your risk and raise your returns. Diversifying their portfolios is one way for investors to reduce the effects of changes in the market and get the best balance between risk and gain. This strategic method lets investors take advantage of growth opportunities while protecting themselves against possible losses. This increases the overall return on investments.

Active Portfolio Management

Active portfolio management means keeping an eye on and making changes to your investments all the time to take advantage of market trends and chances. Investors can take advantage of good market conditions, lower their risks, and get the best returns by carefully managing their portfolios. This proactive method helps investors adjust to changing market conditions and get the most out of their investments, which helps them reach their financial goals more quickly and easily.

Exploring Alternative Investments

Alternative investments, like real estate, private equity, and mutual funds, can help you diversify your portfolio and possibly earn more money. By adding alternative investments to their portfolios, investors can get returns that aren’t tied to the success of their other investments. This smart allocation lets buyers make money in niche markets and other types of assets, spreading out risk and increasing returns.

Comparing Money Market Accounts with Other Investment Options

When looking at different ways to invest your money, it’s important to know how money market accounts are different from other choices like savings accounts, CDs, and mutual funds. Investors can pick the choice that fits their financial goals and preferences the best by looking at its risk, return potential, and liquidity.

Savings Accounts

Savings accounts are a safe way to keep money while making interest. They make it easy to get your money and are backed by the FDIC. Savings accounts, on the other hand, tend to have lower interest rates than money market accounts. This means that they are better for short-term savings and emergency funds than for long-term investing.

Certificates of Deposit (CDs)

CDs earn more interest than savings accounts, but you have to keep the money in them for a set amount of time. CDs offer stable returns and are backed by the FDIC, but they are not as flexible as money market accounts. Investors must think about how quickly they need cash and how long they want to hold on to their money when deciding between CDs and money market accounts.

Mutual Funds

Mutual funds take money from many investors and put it in a wide range of securities. This can lead to higher returns, but also higher risks. Mutual funds are more vulnerable to market changes and management fees than money market accounts. Before choosing between mutual funds and money market accounts, investors should think about how much risk they are willing to take and what their financial goals are.

Factors to Consider When Choosing a Money Market Account

When comparing investments, it’s important to think about things like your risk tolerance, financial goals, cash flow needs, and time frame. Money market accounts are good for storing and managing cash because they offer a good mix of stability, liquidity, and low returns. Investors should think about what’s most important to them and then compare the pros and cons of each choice.

Tips for Managing Money Market Accounts Effectively

To manage money market accounts well, you have to make strategic choices about how to get the best returns while keeping the funds stable and liquid. Monitoring, reviewing, and rebalancing your stock on a regular basis are all important practices. Investors can make smart choices about how to best use their money market accounts by keeping up with market trends and thinking about the tax effects of their choices.

Regular Monitoring and Review

Making sure that your money market account fits with your financial goals and risk tolerance means keeping an eye on it all the time. When you do regular reviews, you can check interest rates, fees, and any changes in the market. This lets you make changes to your investment plan at the right time to get the best returns.

Periodic Portfolio Rebalancing

Rebalancing your money market account portfolio on a regular basis makes sure that your asset allocation stays in line with your financial goals and level of risk tolerance. During rebalancing, you change how your money is invested in different assets to maintain the balance of stability and potential returns that you want. This improves the general performance of your portfolio.

Considering Tax Implications

It is very important to know how your money market account affects your taxes in order to handle them well. Money market accounts are stable and easy to get cash from, but the interest you earn is taxed as regular income. Investors can get the most out of their money market accounts and get the best returns after taxes by thinking about taxes and looking into tax-efficient tactics.

Staying Informed About Market Trends

To make smart choices about your money market account, you need to know what’s going on in the economy and the market. Keeping up with changes in interest rates, regulations, and economic data can help you project changes in the market and make changes to your investment plan as needed. This will help you keep your money market account organized and performing at its best.

Conclusion

In conclusion, finding the perfect mix between stability and returns is very important in the dynamic world of investments. Money market accounts are one of the best ways to find this balance because they offer buyers safety, liquidity, and small returns. Investors can confidently and successfully handle the financial world if they follow smart management tips and stay up to date. Stay Up-to-date with City Entreprise Blogs About Money Market Trends.