There has been a lot of discussion about how cryptocurrency could affect the banking business since it came out. People around the world are becoming more interested in digital currencies. This raises the question of whether bitcoin will save the banking industry and make it more feasible, or whether it will destroy traditional banks and make them useless. When you put innovation against tradition and instability against stability, you have a situation that shows how complicated the link between cryptocurrency and banking is. The article looks at the different points of view by looking at the history of Cryptocurrency, the problems banks are having, and how digital currencies could change the world. By looking at how these two areas interact with each other, we are hoping to shed light on the uncertain but very important future that both cryptocurrency and the banking industry face.

Evolution of Cryptocurrency

The history of cryptocurrency is very interesting, with many innovative developments and big changes in the way money works. Since Satoshi Nakamoto, who went by the name Satoshi, created Bitcoin in 2009, cryptocurrency has grown into a huge environment with thousands of different digital items. Proof of Value and Delegated Proof of Stake are two new decision methods that have come about because of this evolution. Blockchain technology, growth solutions, and smart contracts have also improved. Also, the rise of alternative cryptocurrencies, or digital currencies, has made the market even more different by adding new features and uses that go beyond just digital cash.

Challenges Faced by the Banking Industry

With the economy changing and technology getting better, the banking business has to deal with many problems. From following rules to protecting themselves from online threats, banks have to deal with a lot of tricky situations to keep their operations running smoothly and earn customer trust.

Regulatory Compliance

Banks have to follow strict rules set by regulators, which often comes with high costs and makes operations more difficult. To reduce risks and keep up with governmental compliance standards, it’s important to keep up with changing rules and put strong compliance measures in place.

Cybersecurity Threats

Cybersecurity threats to banks are getting worse, including data leaks and hits that target private customer data. Banks spend money on advanced security protocols and means to protect their systems and customer data from new cyber threats and to keep them safe.

Technological Disruption

Traditional banking models are having a hard time keeping up with how quickly technology is changing things. This is forcing banks to adapt to digital transformation trends. To stay competitive in a world where technology is changing things all the time, banks need to use financial solutions, improve their digital systems, and make sure that customers have a smooth digital experience.

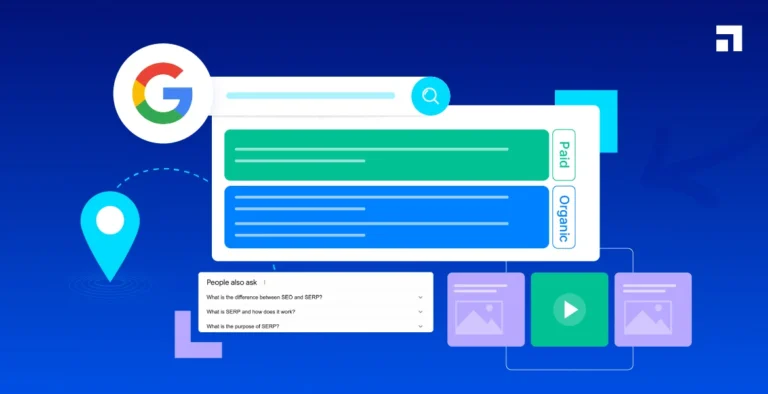

Impact of Cryptocurrency on the Banking Industry

The rise of cryptocurrency has caused big changes in the banking industry. Banks are trying to figure out what this digital currency revolution means for them, from changing standard payment systems to questioning the rules that guide them.

Problems with Payment Systems

Cryptocurrency adoption is a threat to standard banking payment systems because it provides faster and affordable options. To stay competitive in a financial world that is always changing, banks must change to these new ways of doing business.

Challenges with Regulation

Because cryptocurrencies are distributed, they are hard for banks to regulate because they have to deal with complicated legal systems to make sure they follow the rules and meet customer demand for crypto-related services.

Opportunities for Innovation

The rise of cryptocurrency gives banks chances to try new things, like researching blockchain technology or making new financial goods and services. Taking advantage of these chances can make banks more competitive and useful in the digital world.

Opportunities Presented by Cryptocurrency

Cryptocurrency offers a wide range of possibilities in many fields, from finance to technology and more. Because it is open, it helps more people get access to money, lets people send and receive money across borders, and encourages new developments in blockchain technology.

Financial Inclusion

Cryptocurrency encourages financial inclusion by giving people around the world who don’t have bank accounts access to financial services. This lets people join in the global economy even without traditional banking systems.

Unlimited Transactions

Cryptocurrency makes it possible to do transactions across borders, which means that foreign transfers can be made easily and inexpensively without the need for agents or currency conversion fees. This means that businesses and people can easily and quickly do business with each other across physical boundaries.

Blockchain Innovation

Blockchain technology is always getting better because of cryptocurrencies. These cryptocurrencies help make distributed applications (DApps), smart contracts, and digital resource management solutions possible. This makes it possible for disruptive innovations to happen in many fields, such as healthcare, banking, and supply chain management.

Risks Associated with Cryptocurrency Adoption

Adopting cryptocurrencies could have some benefits, but they also come with risks that people and companies need to think about. To make smart choices about investments and deals involving cryptocurrencies, it’s important to understand the risks involved, ranging from unstable prices and unclear regulations to security holes.

Price Changes

Cryptocurrency markets are very unstable, and prices can change very quickly, which can cause buyers to lose a lot of money. Price changes can be hard for people and businesses that want to keep their investments and financial activities stable.

Regulatory Uncertainty

Different places have different rules and methods to regulating cryptocurrencies, so the legal situation is still not clear. Regulatory changes and actions can affect whether or not cryptocurrency investments and operations are legal and able to run. This can make it harder for companies and users to follow the law and put them at risk of legal problems.

Security Risks

Hacking attacks, spam frauds, and theft of digital assets are all security holes that can happen with cryptocurrency operations. People who use exchanges and wallets that aren’t properly protected could lose money or get illegal access to private data. This shows how important strong security measures and risk management are for people who want to use cryptocurrencies.

Responses from the Banking Industry

The banking industry’s responses show a mixed view on the use of cryptocurrencies. Some banks accept digital currencies and look for ways to integrate them, but others are still hesitant because of regulatory uncertainty and security worries.

Supporting Digital Innovation

Cryptocurrency and blockchain technology have a lot of promise, and forward-thinking banks are investing in research and development to find new ways to use them and solve problems. In the digital market, banks can stay competitive and meet changing customer needs by adopting digital innovation.

Following the rules

In their approach to cryptocurrency adoption, many banks put legal compliance and risk management at the top of their lists. Strong compliance measures help make sure that rules are followed and lower the legal and public image risks that come with investing in and transacting with digital currencies.

Safety Measures

To protect themselves from the risks that might come with using cryptocurrencies, banks put a high priority on cybersecurity and data protection steps. Putting in place strong security procedures and investing in cybersecurity systems makes banks more resistant to hacking, fraud, and people getting into digital assets without permission. This keeps customers money and information safe and secure.

Considerations for Investors and Consumers

People who want to invest in or use cryptocurrencies need to carefully think about a number of things. To minimize risks and maximize opportunities in the digital property time, you need to make well-informed decisions. This includes looking at things like market risk and instability factors, as well as legal compliance and security measures.

Understanding Risk Factors

It is important to learn about the risks that come with investing in cryptocurrencies, such as price volatility, regulatory uncertainty, and security holes, so that you can make smart choices and effectively manage your risk exposure. By looking at risk factors, investors and users can safely and confidently move through the bitcoin market.

Looking at Market Change

Prices can change quickly and without warning on cryptocurrency markets, which are known for being very volatile. Investors and consumers should think about how market volatility might affect their financial transactions and investment portfolios. They should also come up with ways to reduce risks and take advantage of chances when market conditions change.

Conclusion

In conclusion, there is a lot of uncertainty where cryptocurrency and banking meet, but there is also a lot of promise. As digital currencies become more popular, they challenge the rules of standard banking while also opening up new ideas and making money available to more people. The banking industry can change to the changing world and use the transformative power of cryptocurrency for a more stable future by getting around regulatory hurdles, embracing technology progress, and putting security first.